INVESTMENT

Why Investors Still Bet on Water Membranes

Investment highlights continued backing for established water treatment technologies despite a more cautious climate tech market

12 Jan 2026

Investment in water technology has become more selective, but recent activity suggests capital is still flowing to solutions seen as central to long-term water treatment needs. That was evident in late 2025, when membrane developer NanoH2O secured new funding, underlining continued investor interest in established water infrastructure technologies.

The deal comes amid uneven investment across climate technology, where funding has increasingly favoured proven systems over early-stage concepts. Industry participants say the NanoH2O round illustrates how some investors remain focused on incremental innovation that builds on existing infrastructure, particularly in sectors such as water where reliability and scale are critical.

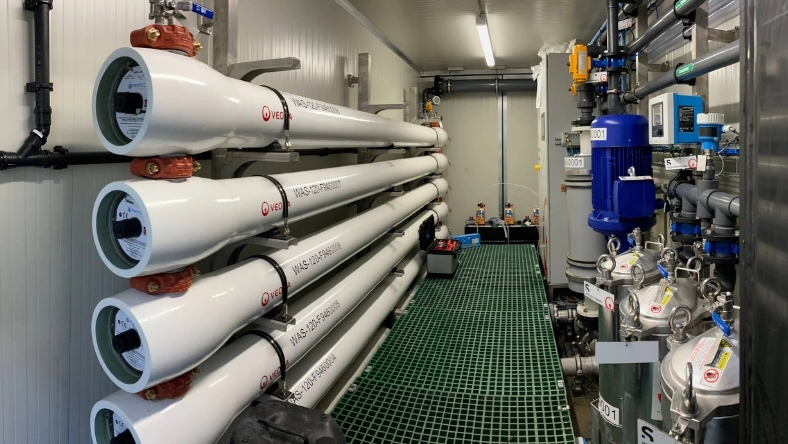

NanoH2O develops membranes used in desalination and water reuse plants. The membranes act as high-performance filters, separating fresh water from salt and other contaminants. Improvements in membrane efficiency can reduce energy consumption, increase output and lower operating costs over the life of a facility, making them attractive to utilities and industrial users facing rising costs and tighter regulation.

The latest funding round included continued participation from Mubadala and Glenwood Partners, both long-standing investors in the company. Follow-on investments are often viewed as a signal that backers remain confident in a technology’s commercial prospects, especially in capital-intensive markets where deployment timelines are long.

Analysts say membrane technology has retained its appeal because it can be integrated into existing plants without major changes to design or operations. This fits with a broader trend in the water sector, where operators are prioritising upgrades that improve performance while limiting disruption and capital expenditure.

Demand for such solutions is being shaped by structural pressures including water scarcity, population growth and stricter environmental oversight. As a result, technologies that offer incremental gains while leveraging installed assets are expected to see steady, if unspectacular, growth.

Competition among membrane suppliers is increasing, and buyers are placing greater emphasis on durability, efficiency and environmental performance. While this has made capital more cautious, the NanoH2O investment suggests that interest in core water treatment technologies remains intact.

For an industry defined by long planning cycles and a premium on dependability, that consistency may continue to support gradual but meaningful progress.

Latest News

26 Feb 2026

The Water Squeeze in Gulf Oilfields24 Feb 2026

Industrial Water Gets a $500M Makeover in Jubail16 Feb 2026

Oilfield Wastewater Finds a Second Life12 Feb 2026

Produced Water Gains New Value in a Thirsty Gulf

Related News

REGULATORY

26 Feb 2026

The Water Squeeze in Gulf Oilfields

PARTNERSHIPS

24 Feb 2026

Industrial Water Gets a $500M Makeover in Jubail

INSIGHTS

16 Feb 2026

Oilfield Wastewater Finds a Second Life

SUBSCRIBE FOR UPDATES

By submitting, you agree to receive email communications from the event organizers, including upcoming promotions and discounted tickets, news, and access to related events.