INSIGHTS

When Water, Not Oil, Drives Upstream Decisions

Rising water volumes and regulation are pushing oil and gas groups to treat produced water as a strategic planning issue

5 Jan 2026

Produced water is moving higher on the strategic agenda for oil and gas producers across the Middle East, as rising volumes begin to shape investment decisions, technology choices and long-term field planning.

Once handled largely as a routine byproduct, produced water has become more prominent as reservoirs mature and water cuts increase. Operators are facing higher handling and treatment requirements at the same time as regulators place greater emphasis on environmental protection and efficient water use, particularly in water-stressed economies.

Industry discussions suggest that national energy companies are increasingly linking water management to broader sustainability goals. Water reuse, reinjection and alternative disposal options are being assessed alongside traditional production considerations, reflecting a shift in how upstream assets are evaluated over their full life cycle.

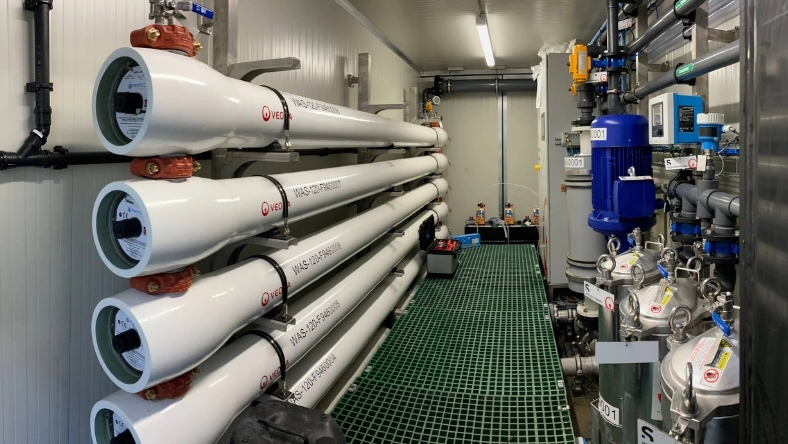

Service companies are adapting to this change. Veolia, among others, has been expanding its focus in the region from basic produced water handling towards more flexible treatment systems. These are designed to allow operators to choose between reuse, reinjection or compliant discharge depending on local water quality and regulatory requirements, rather than relying on a single standard solution.

Industry analysts say this flexibility marks a turning point. Produced water is now being discussed as a potential resource if treated appropriately, rather than solely a disposal problem. Pilot projects and partnerships point to growing interest in technologies that can operate reliably at scale over long field lifetimes.

National oil companies are playing a central role. ADNOC and Saudi Aramco have both launched water sustainability initiatives, including seawater treatment projects and pilot reuse programmes, which could reduce future demand for freshwater. While still at an early stage, these efforts underline rising institutional attention to produced water management.

The commercial implications are becoming clearer. Analysts estimate the Middle East and North Africa produced water treatment market at about $2.22bn in 2024, with forecasts rising to roughly $3.38bn by 2030. Growth is expected to favour providers with strong engineering capabilities and regional experience, even as high upfront costs and evolving reuse regulations remain obstacles.

Despite these challenges, momentum is building. Produced water considerations are increasingly influencing how upstream projects are designed, assessed and financed, positioning water strategy as a contributor to resilience and long-term value in Middle East energy development.

Latest News

24 Feb 2026

Industrial Water Gets a $500M Makeover in Jubail16 Feb 2026

Oilfield Wastewater Finds a Second Life12 Feb 2026

Produced Water Gains New Value in a Thirsty Gulf10 Feb 2026

Zero Solids Recycling Signals a New Water Play in the Permian

Related News

PARTNERSHIPS

24 Feb 2026

Industrial Water Gets a $500M Makeover in Jubail

INSIGHTS

16 Feb 2026

Oilfield Wastewater Finds a Second Life

REGULATORY

12 Feb 2026

Produced Water Gains New Value in a Thirsty Gulf

SUBSCRIBE FOR UPDATES

By submitting, you agree to receive email communications from the event organizers, including upcoming promotions and discounted tickets, news, and access to related events.