INVESTMENT

Saudi Arabia’s Water Gamble Goes Small to Win Big

Kingdom uses public-private partnerships to expand small-scale purification and strengthen water security

15 Dec 2025

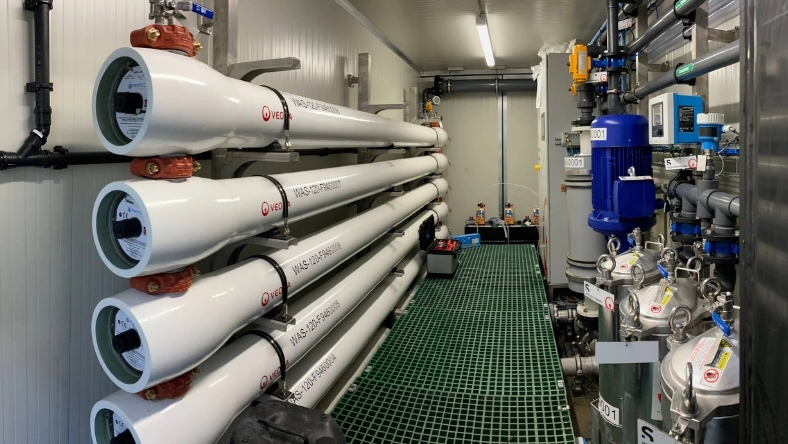

Saudi Arabia is reshaping its water sector by moving away from large, centralised plants and towards a network of smaller purification facilities, a shift that is changing how projects are financed and operated and attracting growing interest from private investors.

The approach, outlined in a recent Middle East Water Tech Brief, centres on deploying multiple decentralised water treatment sites through public-private partnerships. Together, the facilities are expected to supply more than 18,000 cubic metres of treated water a day, underscoring the scale of public backing and the urgency of strengthening long-term water security in the arid kingdom.

Officials and industry participants say smaller plants can be delivered more quickly and located closer to areas of demand, reducing the need for extensive distribution networks. Capacity can be expanded in stages, limiting upfront costs and allowing supply to adapt as demand changes.

Advocates also argue that decentralisation improves resilience. By spreading production across many sites, the system is less vulnerable to disruption if a single facility fails. Localised plants, they add, make it easier to tailor treatment to specific uses while maintaining national quality standards.

The shift is altering competitive dynamics in the water sector. International technology providers and operators are competing alongside regional engineering and operations groups for future contracts as decentralised projects gain momentum. Industry participants say this is placing greater emphasis on operational performance, technical expertise and long-term reliability, rather than price alone.

For large industrial groups such as Saudi Aramco, greater confidence in decentralised treatment could influence future decisions on water reuse and efficiency, particularly in remote or industrial locations where central supply is less practical.

More broadly, the strategy reflects a regional push to use private capital and expertise to meet rising demand while easing pressure on public finances. Analysts note that public-private partnerships can help spread risk and encourage innovation, but they also bring challenges. Managing many smaller facilities increases complexity, making consistent regulation and oversight critical.

Supporters say the momentum behind decentralised purification is strong and aligns with wider sustainability goals. If the programme delivers as planned, it could offer a model for other water-stressed countries seeking flexible and reliable solutions.

Latest News

16 Feb 2026

Oilfield Wastewater Finds a Second Life12 Feb 2026

Produced Water Gains New Value in a Thirsty Gulf10 Feb 2026

Zero Solids Recycling Signals a New Water Play in the Permian6 Feb 2026

Water From Air Signals a Cautious Shift Beyond Desalination

Related News

INSIGHTS

16 Feb 2026

Oilfield Wastewater Finds a Second Life

REGULATORY

12 Feb 2026

Produced Water Gains New Value in a Thirsty Gulf

PARTNERSHIPS

10 Feb 2026

Zero Solids Recycling Signals a New Water Play in the Permian

SUBSCRIBE FOR UPDATES

By submitting, you agree to receive email communications from the event organizers, including upcoming promotions and discounted tickets, news, and access to related events.