INVESTMENT

How Saudi Arabia Made Water Investable

Saudi Arabia’s water PPPs are reshaping the sector, cutting risk and pulling in global capital through long-term, state-backed contracts

26 Jan 2026

Saudi Arabia is quietly changing how the world looks at water investment. What was once a state-funded utility is starting to resemble a stable, investable asset. The shift matters well beyond the Kingdom, as countries face rising demand for secure water supplies alongside energy transition goals.

At the heart of this change is the Saudi Water Partnership Company. Its use of standardized, long-term contracts backed by the government has sent a clear signal to investors. Water is no longer an afterthought. It is now a core part of national infrastructure planning.

For developers and lenders, the appeal is straightforward. These partnerships reduce uncertainty and create predictable cash flows. That combination has long been rare in water projects, where regulatory risk and fragmented ownership often kept private capital away. Today, investors who once focused on power, renewables, or transport are taking a closer look at desalination plants, wastewater treatment facilities, pipelines, and storage reservoirs.

The story is less about mergers or corporate consolidation and more about structure. By fixing the rules of the game, Saudi Arabia has made it easier to finance projects at scale. That structural shift may prove more important than any single deal.

Water reuse is also gaining attention. Advanced treatment and industrial reuse remain early-stage markets, but they feature more prominently in policy discussions. As demand from industry and energy users grows, the PPP framework could offer a clear path to scale.

Many in the industry see echoes of the power sector a decade ago, when long-term contracts turned complex assets into mainstream investments. Firms with deep project finance experience are already positioning themselves. ACWA Power is often cited as an example of how this model can work in practice.

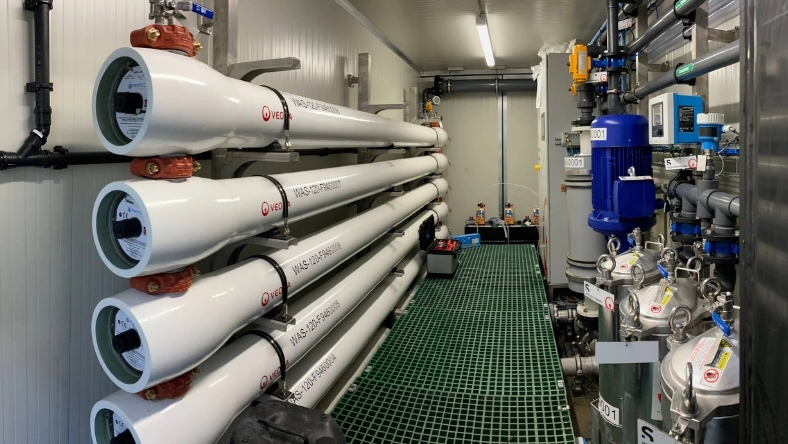

Technology providers are watching closely as well. Companies like Veolia note that stable contracts can support the rollout of advanced treatment systems, especially as environmental standards tighten.

Risks remain. Some investors worry about reliance on a single public buyer. Others question whether standardized contracts can capture the complexity of wastewater and reuse projects. Still, most see these as manageable issues.

Momentum is building. By aligning water infrastructure with the financial logic used in energy projects, Saudi Arabia is offering a template that could spread across the Middle East. Water, once overlooked, is moving to the center of the infrastructure conversation.

Latest News

16 Feb 2026

Oilfield Wastewater Finds a Second Life12 Feb 2026

Produced Water Gains New Value in a Thirsty Gulf10 Feb 2026

Zero Solids Recycling Signals a New Water Play in the Permian6 Feb 2026

Water From Air Signals a Cautious Shift Beyond Desalination

Related News

INSIGHTS

16 Feb 2026

Oilfield Wastewater Finds a Second Life

REGULATORY

12 Feb 2026

Produced Water Gains New Value in a Thirsty Gulf

PARTNERSHIPS

10 Feb 2026

Zero Solids Recycling Signals a New Water Play in the Permian

SUBSCRIBE FOR UPDATES

By submitting, you agree to receive email communications from the event organizers, including upcoming promotions and discounted tickets, news, and access to related events.