PARTNERSHIPS

From Megawatts to Megaliters: Utilities Change Course

TAQA’s GS Inima deal highlights how water assets are becoming a strategic anchor for utilities facing energy volatility

6 Jan 2026

In August 2025 TAQA, a state-backed utility from Abu Dhabi, agreed to buy GS Inima, a global operator of desalination and wastewater plants. The deal, due to close in 2026, was not large by the standards of the energy world. But analysts have seized on it as a sign of a quieter shift: some utilities now see water as central to their future.

For decades power companies focused on electrons and fuels. Water sat in the background, treated as a cost or a regulatory burden. That is changing. Across energy hubs, especially in dry regions, demand for industrial and produced water is rising. At the same time governments are tightening rules on pollution, reuse and freshwater withdrawal. Utilities face pressure not just to supply power, but to manage resources in a visibly responsible way.

Owning water infrastructure can help. Desalination and wastewater plants offer long-lived assets, predictable cash flows and close ties to public policy. In many countries their returns are regulated, which makes them dull but dependable. That is appealing at a time when power markets are more volatile and the pace of the energy transition remains uncertain.

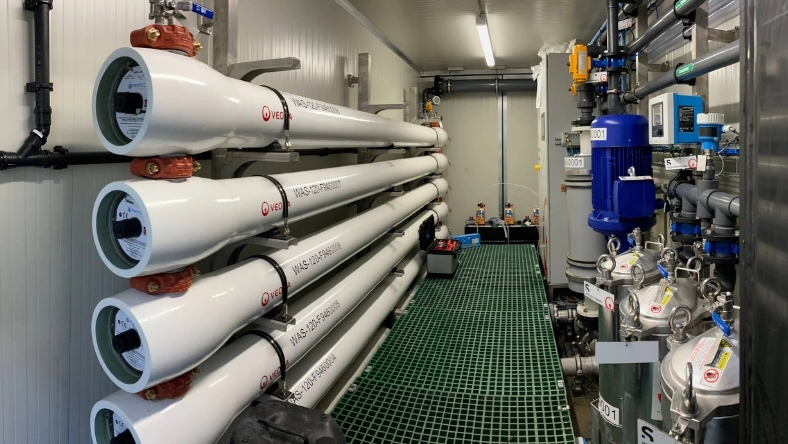

GS Inima brings TAQA experience across desalination, municipal wastewater and industrial water treatment in several regions. It is not an oil-and-gas specialist. Yet its skills matter as energy and industrial sites generate more complex water streams that must be treated, reused or discharged safely. Folding such expertise into a utility group allows power, water and industrial services to be planned together, rather than bolted on later.

Other firms are circling similar ideas. Strategy updates and infrastructure reports increasingly describe water as a stabilising line of business. Utilities with in-house water platforms may gain an edge when bidding for large industrial zones or energy-linked developments, where integrated services are prized.

The risks should not be ignored. Managing assets across regions brings operational headaches, and aligning performance across power and water businesses is not easy. Water projects can also attract political scrutiny when prices rise or shortages bite.

Even so, the direction is clear. As the energy transition redraws balance-sheets, some utilities are looking beyond power plants and grids. Water, once an afterthought, is edging towards the centre of their plans.

Latest News

24 Feb 2026

Industrial Water Gets a $500M Makeover in Jubail16 Feb 2026

Oilfield Wastewater Finds a Second Life12 Feb 2026

Produced Water Gains New Value in a Thirsty Gulf10 Feb 2026

Zero Solids Recycling Signals a New Water Play in the Permian

Related News

PARTNERSHIPS

24 Feb 2026

Industrial Water Gets a $500M Makeover in Jubail

INSIGHTS

16 Feb 2026

Oilfield Wastewater Finds a Second Life

REGULATORY

12 Feb 2026

Produced Water Gains New Value in a Thirsty Gulf

SUBSCRIBE FOR UPDATES

By submitting, you agree to receive email communications from the event organizers, including upcoming promotions and discounted tickets, news, and access to related events.